The only documents you absolutely need to keep in paper form are those that are a hassle to replace, such as birth, marriage and death certificates. Back up your computer regularly to a secure online service or to a disk or drive you can store off site. Virtually any document you get in paper form can be scanned paper receipts needed for tax purposes should be, since many receipts fade over time otherwise and become unreadable.

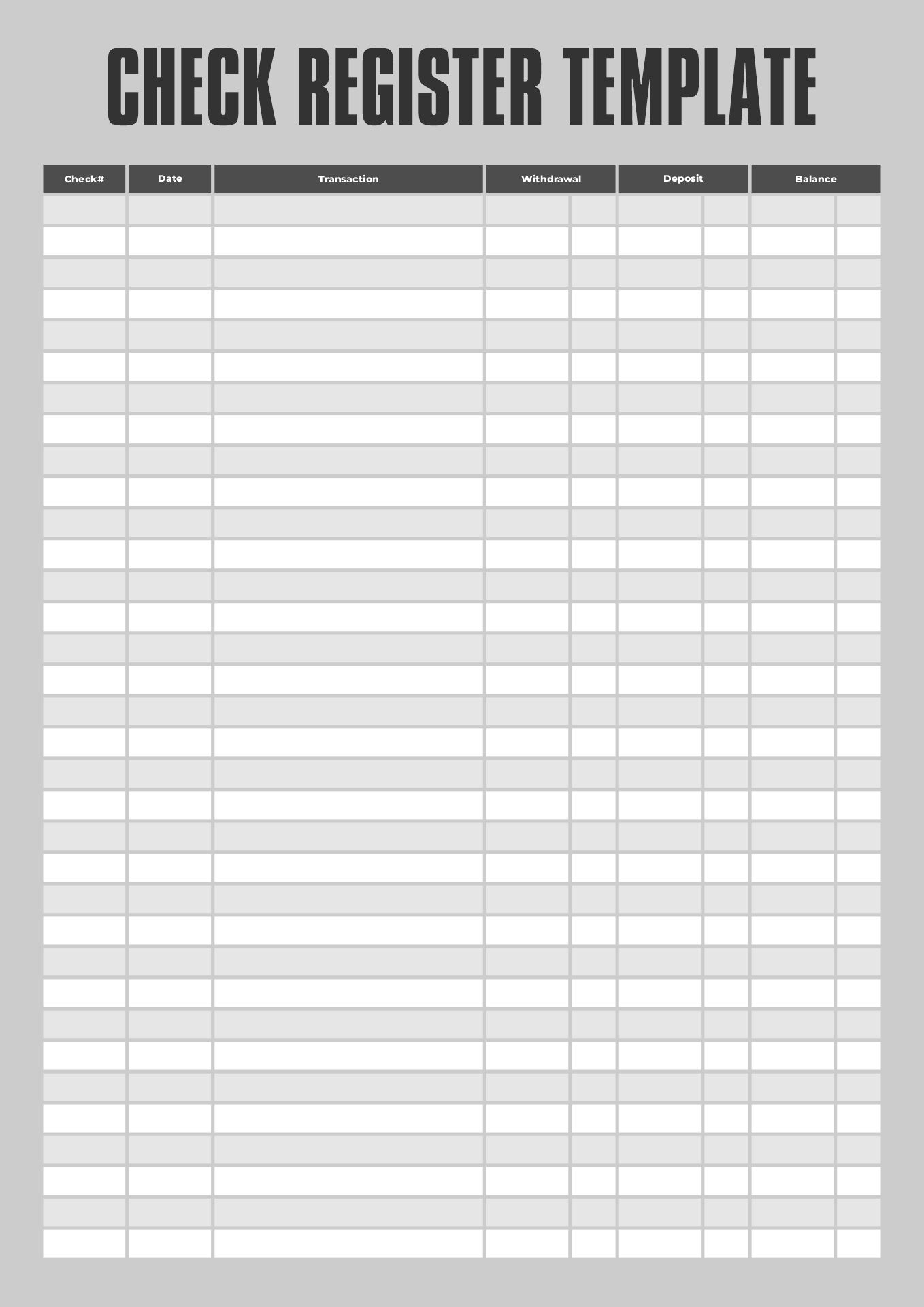

#Checkbook registers for personal checkbook download

Services such as FileThis can automatically download electronic statements into your computer, relieving you of this chore each month. You can reduce the paperwork that comes into your home by opting for electronic statements and receipts whenever possible. The IRS accepts electronic documents, and so does nearly everyone else. Betterment, Wealthfront, Charles Schwab Intelligent Portfolios and Vanguard Personal Advisor Services are among the investment managers that use technology to automate investing. Or we can invest our money with an automated financial advisor that uses computer algorithms to allocate and rebalance our funds. Now we can outsource this burdensome task by buying target-date retirement funds, which have asset allocation and rebalancing services baked in. If we failed to rebalance, we’d get our clocks cleaned when inevitable stock downturns cratered our portfolios. If stocks did particularly well, for example, we’d have to sell some of those and buy some bonds to get our allocations back on track.

In the olden days, we had to decide how much to put where and then regularly rebalance our portfolios back to those target allocations. The right asset allocation - how you divvy up your funds among various classes of stocks, bonds and cash - can help you achieve your investment goals with less risk. The information on each check gives the bad guys every bit of information they need to raid your account.) Rebalance your investments (If you still do write a lot of checks, please switch to more secure payment methods. We still need to monitor our accounts to spot bogus transactions, keep track of our balances and avoid overdrafts, but the monthly ritual of trying to reconcile a statement to a register is pretty much obsolete. These days, though, we write far fewer checks, most transactions post pretty quickly and bank errors are rare. Then you spent the next hour trying to figure out why the totals didn’t match. You compared the transactions on that statement with what you’d recorded in your check register, adding in any deposits and subtracting any checks or other transactions that hadn’t posted by the time the statement was printed. Once upon a time, you got a paper statement each month from your bank.

If you do any of the following chores, you can and should do them a lot differently now: Balance your checkbook Likewise, technology has obliterated or automated a lot of the money tasks that were once mandatory for people who wanted to be responsible with their finances. Tasks that were routine then - like, say, beating a rug to clean it - have all but disappeared. Think about how difficult it was to clean a house 100 years ago, or make a phone call, or travel across the country. Watch Video: 4 habits you can break right now

0 kommentar(er)

0 kommentar(er)